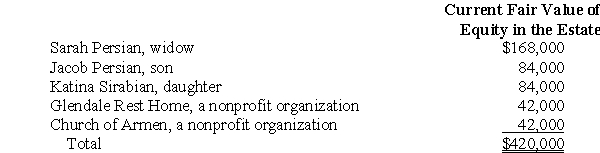

The devisees named in the will of Ara Persian, Deceased, and the current fair value of the devisees' equity in the estate, follow:

The federal estate tax and state inheritance taxes attributable to the Estate of Ara Persian totaled $50,400. Assuming the will of Ara Persian, Deceased, is silent as to the apportionment of death taxes, compute the amount of death taxes to be allocated to each devisee.

The federal estate tax and state inheritance taxes attributable to the Estate of Ara Persian totaled $50,400. Assuming the will of Ara Persian, Deceased, is silent as to the apportionment of death taxes, compute the amount of death taxes to be allocated to each devisee.

a. Death taxes allocable to Sarah Persian $__________

b. Death taxes allocable to Jacob Persian $__________

c. Death taxes allocable to Katina Sirabian $__________

d. Death taxes allocable to Glendale Rest Home $__________

e. Death taxes allocable to Church of Armen $__________

Correct Answer:

Verified

Q29: Under the Revised Uniform Principal and Income

Q30: Items in the inventory of property of

Q31: The individual or organization named in a

Q32: Given the following classification of claims of

Q33: The following journal entry (explanation omitted) appeared

Q34: Among the transactions and events of Ruth

Q35: Among the journal entries prepared by the

Q36: Prepare journal entries for the following selected

Q38: Franz Josi died on September 15, 2005.

Q39: The only liabilities included in the journal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents