On July 1, 2001, Sixty Company, the 90%-owned subsidiary of Pandle Corporation, issued to the public $100,000 face amount of 7% bonds (interest payable annually) due July 1, 2006, for $92,221, a yield rate of 9%. On June 30, 2003, when the carrying amount of the bonds was $94,938, Pandle acquired $40,000 face amount of the outstanding 7% bonds in the open market for $37,016, a yield rate of 10%.

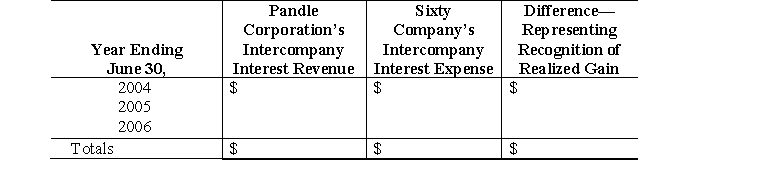

Prepare a working paper to show how the $959 intercompany gain realized by Sixty on June 30, 2003, will be recognized in the accounting records of Pandle Corporation and Sixty Company for the three years ending June 30, 2006. Use the following format:

Correct Answer:

Verified

Q39: Intercompany loans, operating leases of property, and

Q40: A working paper elimination (in journal entry

Q41: Patch Corporation accounts for the investment in

Q42: On May 1, 2003, Spe Company sold

Q43: On November 1, 2005, Phaser Corporation issued

Q44: Purkle Corporation purchased merchandise from its 94%-owned

Q46: The working paper eliminations (in journal entry

Q47: The Notes Payable ledger account of Santos

Q48: During the fiscal year ended December 31,

Q49: Included in the working paper eliminations (in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents