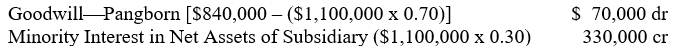

Pangborn Corporation paid $840,000 (including direct out-of-pocket costs) for 70% of the outstanding common stock of Siddon Company on September 30, 2006, the end of Pangborn's fiscal year. Included in the working paper elimination (in journal entry format) for Pangborn Corporation and subsidiary on that date were the following: If Pangborn had inferred a current fair value for 100% of Siddon's total net assets from the $840,000 cost, Goodwill and Minority Interest in Net Assets of Subsidiary in the September 30, 2006, working paper elimination would have been, respectively:

If Pangborn had inferred a current fair value for 100% of Siddon's total net assets from the $840,000 cost, Goodwill and Minority Interest in Net Assets of Subsidiary in the September 30, 2006, working paper elimination would have been, respectively:

A) $100,000 and $330,000

B) $70,000 and $360,000

C) $49,000 and $231,000

D) $100,000 and $360,000

E) Some other amounts

Correct Answer:

Verified

Q14: Under the parent company concept of consolidated

Q15: Because minority stockholders exercise no ownership control

Q16: The Financial Accounting Standards Board requires push-down

Q17: The terms

Q18: In a business combination resulting in a

Q20: On March 31, 2006, Preston Corporation acquired

Q21: Consolidated financial statements are prepared when a

Q22: Consolidated financial statements are not appropriate if:

A)

Q23: On March 1, 2006, Pride Corporation paid

Q24: On October 31, 2006, Portugal Corporation acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents