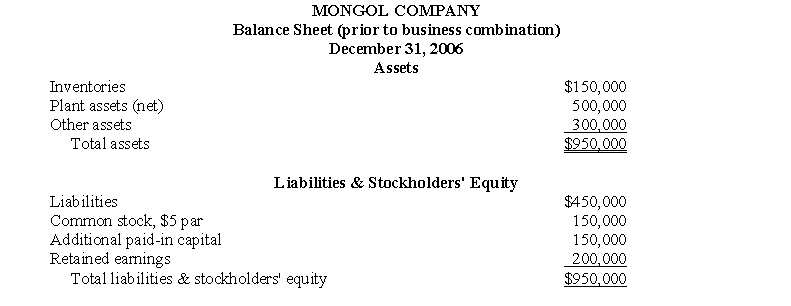

The balance sheet of Mongol Company on December 31, 2006, prior to its merger with Solway Corporation, was as follows:

On December 31, 2006, Solway issued 60,000 of its $10 par (current fair value $15) common stock for all the outstanding common stock of Mongol, which was then liquidated. Also on December 31, 2006, Solway paid $60,000 out-of-pocket costs in connection with the business combination, of which $25,000 were finder's, accounting, and legal fees directly related to the combination, and $35,000 were costs of registering and issuing the common stock to effect the combination. Current fair values of Mongol's inventories and plant assets were $180,000 and $620,000, respectively; other assets and liabilities had current fair values equal to their carrying amounts.

On December 31, 2006, Solway issued 60,000 of its $10 par (current fair value $15) common stock for all the outstanding common stock of Mongol, which was then liquidated. Also on December 31, 2006, Solway paid $60,000 out-of-pocket costs in connection with the business combination, of which $25,000 were finder's, accounting, and legal fees directly related to the combination, and $35,000 were costs of registering and issuing the common stock to effect the combination. Current fair values of Mongol's inventories and plant assets were $180,000 and $620,000, respectively; other assets and liabilities had current fair values equal to their carrying amounts.

Prepare journal entries on December 31, 2006, for Solway Corporation to record the business combination with Mongol Company. Disregard income taxes.

Correct Answer:

Verified

Q15: The business enterprises that enter into a

Q16: Which of the following is not included

Q17: On March 1, 2006, Selig Corporation acquired

Q18: Direct out-of-pocket costs of a business combination

Q19: Slocum Corporation and Merton Company, both publicly

Q20: Subsequent to the date of a business

Q21: On May 1, 2006, Regis Corporation acquired

Q23: The balance sheet of Mintmore Company on

Q24: On May 31, 2006, Combinor Corporation issued

Q25: Paragraph 43 of FASB Statement No. 141,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents