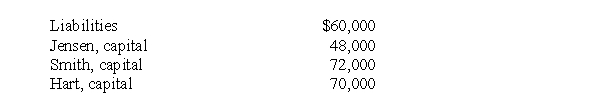

The partners of Jensen, Smith & Hart LLP shared net income and losses in the ratio of 5:3:2, respectively. The partners decided to liquidate the partnership when its assets consisted of cash, $40,000, and other assets, $210,000; the liabilities and partners' capital were as follows:  If other assets with a carrying amount of $120,000 realized $90,000, the amount of cash that each partner may receive at that time is:

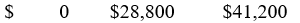

If other assets with a carrying amount of $120,000 realized $90,000, the amount of cash that each partner may receive at that time is:

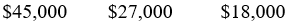

A)

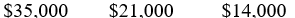

B)

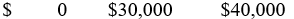

C)

D)

Correct Answer:

Verified

Q25: In the installment liquidation of a limited

Q26: If a liquidating limited liability partnership is

Q27: The following condensed balance sheet is for

Q28: According to the Uniform Partnership Act, unpaid

Q29: Oliver, Patrick & Quincy LLP, is beginning

Q31: The balance sheet of Ames, Beard &

Q32: After realization of a portion of the

Q33: The balance sheet of Quanto, Rollo &

Q34: The partners of Dunn, Carson & Devlin

Q35: The partners of Hendry & Kim LLP

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents