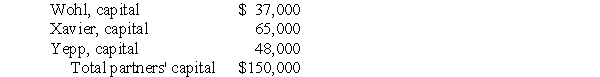

The partners of Wohl, Xavier, and Yepp LLP shared net income and losses in a 5:3:2 ratio, respectively. The capital account balances on April 30, 2006, were as follows:  The carrying amounts of the assets and liabilities of the partnership were the same as their current fair values. Zabb was to be admitted to the partnership with a 20% capital interest and a 20% share of net income and losses in exchange for a cash investment. No goodwill or bonus was to be recognized. The amount of cash that Partner Zabb should invest in the partnership is:

The carrying amounts of the assets and liabilities of the partnership were the same as their current fair values. Zabb was to be admitted to the partnership with a 20% capital interest and a 20% share of net income and losses in exchange for a cash investment. No goodwill or bonus was to be recognized. The amount of cash that Partner Zabb should invest in the partnership is:

A) $30,000

B) $36,000

C) $37,500

D) $40,000

E) Some other amount

Correct Answer:

Verified

Q20: The partnership contract for Pyle & Quan

Q21: Bruce Chapman was admitted to the Adams

Q22: On January 31, 2006, Amy Reid withdrew

Q23: The partners of Ames, Brod, and Chan

Q24: If a partner who retires from a

Q26: The appropriate format of the January 31,

Q27: Alf and Ben, partners in Alf &

Q28: On June 30, 2006, the balance sheet

Q29: Are per unit amounts disclosed in a

Q30: When Elsa Martin withdrew from Lewis, Martin,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents