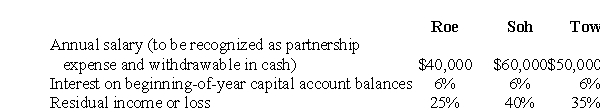

Roe, Soh, & Tow Limited Liability Partnership was organized and began operations on February 1, 2005, with the following capital account balances: Roe, $50,000; Soh, $70,000; Tow, $80,000. The income-sharing arrangement provided for the following:

For the fiscal year ended January 31, 2006, Roe, Soh, & Tow Limited Liability Partnership had income of $180,000, before recognition of salaries expense, and the partners withdrew their authorized salaries in cash.

For the fiscal year ended January 31, 2006, Roe, Soh, & Tow Limited Liability Partnership had income of $180,000, before recognition of salaries expense, and the partners withdrew their authorized salaries in cash.

Prepare journal entries (omit explanations) for Roe, Soh, & Tow Limited Liability Partnership on January 31, 2006.

Correct Answer:

Verified

Q28: On June 30, 2006, the balance sheet

Q29: Are per unit amounts disclosed in a

Q30: When Elsa Martin withdrew from Lewis, Martin,

Q31: The owners' equity ledger accounts for a

Q32: On September 1, 2005, Fox & George

Q34: For the fiscal year ended May 31,

Q35: The partners of Rann & Sloe LLP

Q36: The partners of Bentsen & Cole LLP

Q37: In 2005, the partners of Julio &

Q38: The capital account balances for Ray &

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents