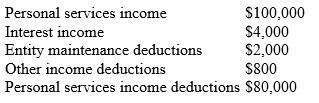

Sandra Livingstone who provides her personal training services through a company called "Get Fit Pty Ltd," has been unable to satisfy any of the Personal Services Income (PSI) tests to warrant exclusion from the PSI rules. The financial records of the company for the year ended 30 June 2020 indicate the following:

Based on the above information, what amount of income will be attributed to Sandra in the year ended 30 June 2020?

Based on the above information, what amount of income will be attributed to Sandra in the year ended 30 June 2020?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Anthony contributed $5,000 into his spouse's superannuation

Q15: Harry is 56 and is under preservation

Q16: Eddie is single and a resident and

Q17: Christine is a 45-year-old single woman. For

Q18: Domenic is a practising lawyer and he

Q19: Robert is a resident and during the

Q20: Shane Edwards, is a resident individual who

Q21: On 1 November 2019 David Martin received

Q22: Meg Ryan is paid a superannuation lump

Q24: Tim Rodgers, aged 64, is a resident

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents