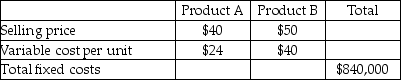

Mount Carmel Company sells only two products, Product A and Product B.

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%.

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%.

Required:

a. What is the breakeven point in units for each product assuming the sales mix is 2 units of Product A for each unit of Product B?

b. What is the breakeven point if Mount Carmel's tax rate is reduced to 25%, assuming the sales mix is 2 units of Product A for each unit of Product B?

c. How many units of each product would be sold if Mount Carmel desired an after-tax net income of $73,500, facing a tax rate of 30%?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Answer the following questions using the information

Q7: Answer the following questions using the information

Q8: Nadya's Niche sells a single product. 8,000

Q9: Maha Manufacturing produces a single product that

Q10: Badr Gulf Manufacturing produces a single product

Q11: A company with sales of $50,000, variable

Q12: Sultan Suns sells a single product. The

Q13: In 2014, Lulu & Latif Company has

Q14: Riyadh Engines sells car batteries to service

Q16: What would be the expected monetary value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents