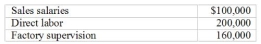

The journal entry to record the above should be:

Belmont Corporation incurred the following labor costs during the month of July, 2007:

A) Debit Manufacturing Overhead $460,000 and credit Salaries and Wages Payable $460,000

B) Debit Salary expense $460,000 and credit salaries and wages payable $460,000

C) Debit Work-in-Process $200,000, debit salary expense $100,000, debit Manufacturing Overhead . $160,000 and credit Salaries and Wages Payable $460,000

D) Debit Salaries and Wages Payable $460,000, credit Work-in-Process $200,000, credit Salary Expense $260,000

Correct Answer:

Verified

Q66: A Gantt chart:

A) Shows which jobs are

Q67: Stoughton applies overhead to production at a

Q68: What is the cost of goods sold

Q69: Hudson Company incurred $50,000 of depreciation expense

Q70: Oak Bluff Company incorrectly assigns a $50,000

Q72: Chatam Company wrote a check to cover

Q73: The journal entry to record cost of

Q74: If actual manufacturing overhead is greater than

Q75: Fill in the missing items for the

Q76: Fill in the missing items for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents