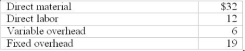

Grupe Inc. has a division located in Spain and another in the U.S. the Spanish division produces a part needed for the product made by the U.S. division. There is substantial excess capacity in the Spanish division. The tax rate of the Spanish division is 35% and U.S. division tax rate is 30%. The part sells externally for $75 and the Spanish division's manufacturing costs are:

Required:

1) What would be the lowest acceptable transfer price for the Spanish division?

2) What would be the highest acceptable transfer price for the U.S. division?

3) What would be the transfer price that would be the best for Grupe Inc and why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: When there is excess capacity in the

Q62: What causes difficulties in measuring opportunity cost

Q63: Which is not a way to set

Q64: Division A is operating at 60 percent

Q65: The output of Division M, which sells

Q67: Explain how the presence or absence of

Q68: Briefly describe the differences between a market-price

Q69: Discuss briefly the issues of goal and

Q70: Division A has no excess production capacity.

Q71: Litwak Inc. has two divisions: production and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents