Use the following to answer questions:

(CMA adapted) Steinberg Industries is considering replacing an existing production machine with a new technologically improved machine effective January 1, 2009. The following information is being considered by Steinberg:

● The new machine would be purchased for $190,000, including costs for shipping, installation, and testing.

● The new machine is expected to increase annual sales by 20,000 units at a sales price of $40 per unit. Incremental operating costs include $30 per unit in variable costs and total fixed costs of $40,000 per year.

● The investment in the new machine will require an immediate increase in working capital of $40,000. This cash outflow will be released at the end of year 5.

● Steinberg uses straight-line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and no salvage value is used in calculating depreciation.

● Steinberg is subject to a 40% income tax rate.

● Steinberg will sell the fully depreciated machine for $20,000 at the end of year 5.

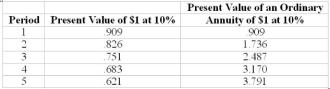

● Steinberg uses the net present value method to analyze investments and will use the following factors and rates:

-The acquisition of the new production machine by Steinberg Industries will contribute a discounted net-of-tax contribution margin of:

A) $200,000

B) $120,000

C) $758,200

D) $454,920

Correct Answer:

Verified

Q61: Ping Inc. is considering an investment in

Q62: Use the following to answer questions:

Parker Industries

Q63: Use the following to answer questions:

Parker Industries

Q64: Use the following to answer questions:

Parker Industries

Q65: Use the following to answer questions:

(CMA adapted)

Q67: Use the following to answer questions:

(CMA adapted)

Q68: Use the following to answer questions:

(CMA adapted)

Q69: Use the following to answer questions:

(CMA adapted)

Q70: Use the following to answer questions:

(CMA adapted)

Q71: Use the following to answer questions:

Exron Corp.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents