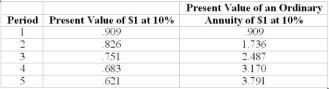

Use the following to answer questions:

Exron Corp. is considering the purchase of a new machine costing $300,000. The new machine will expand Exron's sales capacity and provide $90,000 in additional cash flows (before taxes) over the next five years. The company has decided to depreciate the machine using the straight-line method and no salvage value. At the end of the five years, Exron expects to sell the machine for $20,000.

Exron has a 40% tax rate and uses a 10% discount rate to evaluate the purchase of new machines.

-What is the present value of the machine's depreciation tax shield?

A) $ 90,984

B) $120,000

C) $136,476

D) None of the above

Correct Answer:

Verified

Q67: Use the following to answer questions:

(CMA adapted)

Q68: Use the following to answer questions:

(CMA adapted)

Q69: Use the following to answer questions:

(CMA adapted)

Q70: Use the following to answer questions:

(CMA adapted)

Q71: Use the following to answer questions:

Exron Corp.

Q73: Use the following to answer questions:

Exron Corp.

Q74: Use the following to answer questions:

Exron Corp.

Q75: Petzall Corp. incurred a $9,000 tax liability

Q76: Which one of the following would not

Q77: When analyzing investment options, managers should consider

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents