The oil in well number 66 would be fully drilled after five years of work. The equipment will have no value at the end of this time and will be scrapped. Ahlul uses straight-line depreciation for tax purposes. The tax rate is 30% and Ahlul uses a 12% discount rate in investment proposals. The working capital would be released for other uses at the end of the five years.

Required:

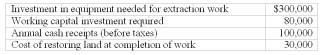

Ahlul Oil Company owns the drilling rights to several oil wells.

The amount of oil in some of the wells is somewhat marginal, and the company is unsure whether it

would be profitable to drill the oil that is contained in these wells. One such oil well is number 66, on

which the following is gathered:

(1) Compute the net present value of Well Number 66.

(2) What should management's decision be?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: When analyzing investment options, managers should consider

A)

Q78: A Real Option Value Decision Tree will

Q79: When reviewing an analysis of investment decisions

Q80: To analyze strategic decisions, real option value

Q81: Compute the expected market growth

A project manager

Q83: Goldman Corp. is considering an investment in

Q84: The cost of capital for Horwitz is

Q85: What are the three general types of

Q86: What is the role of due diligence

Q87: What are three sources of financial information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents