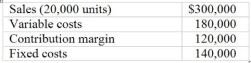

Brewer Corp. is considering dropping its talking dog product line due to continuing losses. Revenue and cost data for the talking dog line for the past year

follow:

follow:

If the talking dog is discontinued, then Brewer could avoid $110,000 per year in fixed costs.

Required:

(1) What is the change in annual operating income from discontinuing the talking dog product line?

___________

(2) Assuming all other conditions stay the same, at what level of annual sales of the talking dog (in units) should Brewer be indifferent at to discontinuing or continuing the product line?

___________

(3) Suppose that if the talking dog is dropped, the production and sale of other products would increase so as to generate a $15,000 increase in the contribution margin received from the other products. If all other conditions are the same, what is the change in annual operating income from dropping the talking dog?

_____

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: Use the following to answer questions:

McCoy Industries

Q61: Use the following to answer questions:

McCoy Industries

Q62: The Sheila Cabot Construction Company (SCCC) is

Q63: Chisel Inc currently produces 30,000 hammers per

Q64: Travis Corporation sells a product for $100

Q65: Sanders Company needs 10,000 units of a

Q66: Jones Corp. currently sells 50,000 units to

Q67: (CMA adapted) Regis Company manufactures plugs used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents