The Callahans are considering moving to a town approximately 20 minutes away. Because of the desirability of the local schools and strict zoning, housing is very expensive in this town. Their daughter would attend public schools. The Facts estimate that their monthly mortgage, taxes and insurance would increase to $7,000 per month, while the cost of running automobiles would increase 20% and other utilities 10%. Mortgage interest costs are tax deductible and the Facts are in the 25% tax bracket. Assume that $700 of the increase in their monthly budget is for mortgage interest. What are the costs and benefits of moving? Which can be quantified and which cannot?

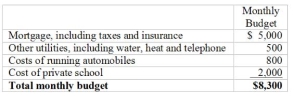

The Callahan family currently lives in a suburb of a major city. They have a lovely home close to major routes of transportation. Both Mr. and Mrs. Callahan have convenient commutes of 30 minutes or less. Because the school system in their town does not have a quality reputation, they currently send their daughter to private school, conveniently located less than one mile from their home. The family's current monthly living expenses are listed below:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Match the following operations with appropriate elements

Q57: Match the following operations with appropriate elements

Q58: Match the following operations with appropriate elements

Q59: Match the following operations with appropriate elements

Q60: The President of the company is considering

Q62: Ignoring income taxes and assuming that cost

Q63: Ignoring income taxes and assuming that cost

Q64: The Cut Stop is a small but

Q65: Linden also noted that Salary Experts quoted

Q66: Castagna also observes that reworking a defective

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents