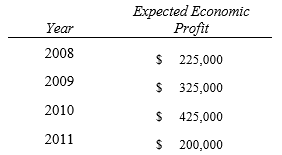

At the beginning of 2008, market analysts expect Atlantis Company, holder of a valuable patent, to earn the following stream of economic profits over the next five years. At the end of five years, Atlantis will lose its patent protection, and analysts expect economic profit to be zero after five years.

If investors apply an annual risk-adjusted discount rate of 15%, the value of Atlantis Company in 2008 is $______________________, which is also the maximum price investors would be willing to pay for Atlantis Company.

A) $726,916

B) $884,912

C) $1,275,000

D) $2,215,000

E) $3,824,318

Correct Answer:

Verified

Q1: Suppose Marv, the owner-manager of Marv's Hot

Q3: A partial income statement from Quest Realty,

Q4: A partial income statement from Quest Realty,

Q5: A partial income statement from Quest Realty,

Q6: A partial income statement from Quest Realty,

Q7: A partial income statement from Quest Realty,

Q8: During a year of operation, a firm

Q9: During a year of operation, a firm

Q10: During a year of operation, a firm

Q11: During a year of operation, a firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents