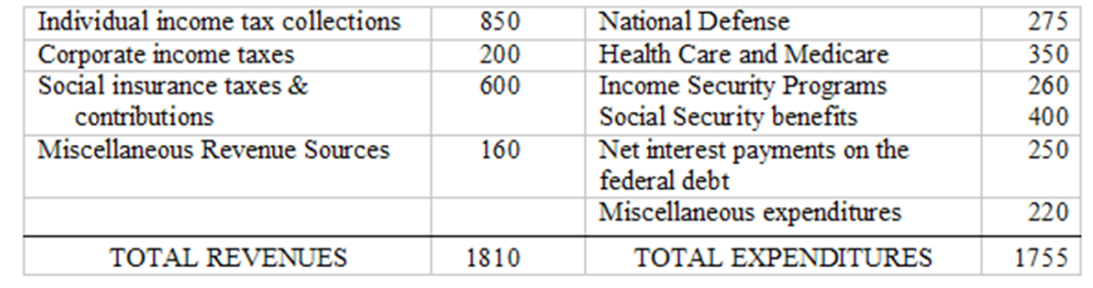

As can be seen from the above table, the budget is in a $55 billion surplus position. If the assumption is made that the government will retire debt, the likely effect will be to reduce total spending in the economy. Under that scenario, prices, employment and interest rates will fall. Note that this net result can occur whether the retired debt is purchased from the nonbank public, depository institutions or Federal Reserve Banks.

What were the government's total revenues and expenditures in the most recent fiscal year? Was the budget in surplus or deficit? All other factors held constant, what is likely to happen to the economy's level of income and interest rates as a result of this year's government budget position? Please explain the reasoning behind your answer to this last question.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Please explain how fiscal and debt management

Q9: What is meant by the term crowding

Q10: Please describe the principal types of securities

Q11: What problems exist when you try to

Q12: Please describe the current auction method or

Q13: Please list the principal goals of Treasury

Q14: Please explain how changes in the maturity

Q15: The government borrowing is likely to result

Q16: Due to drastic cuts in federal spending

Q18: Please calculate the following: the total marketable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents