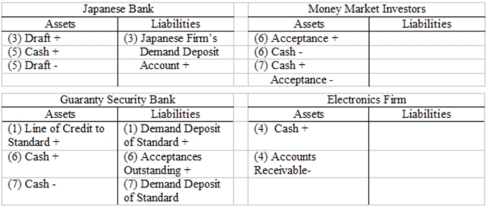

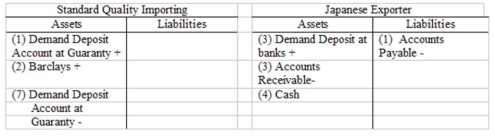

The numbers in the T-account entries above refer to: Standard arranges line of credit with Guaranty. Guaranty issues letter of credit authorizing a time draft. Japanese firm discounts the draft through its principal bank. Japanese firm pays electronics firm.

Japanese bank forwards draft to Guaranty, which "accepts"

it.

Guaranty sells acceptances to the money market through a dealer.

Owner of acceptance presents it to Guaranty for payment.

A banker's acceptance could arise from the situation described quite easily due to the discrepancy between the 90-day promise to pay and the Japanese firm's need for payment within 7 days. The Japanese firm could receive the needed dollars in timely fashion by taking the time draft it receives from the issuing bank to its principal bank and discounting it in advance of its maturity. After 90 days, the holder of the acceptance will present it to Guaranty Security Bank for payment.

A company known as Standard Quality Importing ships videocassette recorders made in Japan to retail dealers in the United States and Western Europe. It decides to place an order with its Japanese supplier for 10,000 Hi-Fi VCRs at $575 each after securing a line of credit from Guaranty Security Bank in Los Angeles. Guaranty issues a credit letter to the Japanese supplier promising payment in U.S. dollars 90 days hence. However, the Japanese firm needs the promised funds within seven days from receipt of the credit letter to make purchases of technical components from an electronics firm in Phoenix, Arizona. Explain and illustrate with T accounts and diagrams how a bankers' acceptance would arise from the foregoing transactions, how the Japanese supplier could receive the dollars she needs in timely fashion and what would happen to the acceptance at the end of the 90-day period. Use T account entries to show the movement of funds from the importer to the Japanese supplier, to the electronics firm and to money market investors.

Correct Answer:

Verified

Q74: Please evaluate the Eurocurrency markets from a

Q75: Commercial paper purchased in the secondary market

Q76: What is the difference in basis points

Q77: A commercial paper note with a $1

Q78: Alamo Corporation requests a $20 million, 90-day

Q79: What price would attach today to Euro

Q80: What is the appropriate discount rate for

Q81: A bank is willing to issue a

Q82: Numbers shown in the T accounts above

Q84: Actions:

(1) Investor withdraws Citi deposit, buys Belgian

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents