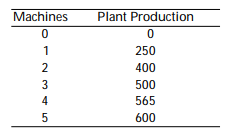

Perpetual plastic plant makers cost $200 each. The number of plants that your firm expects to produce each year for each level of capital stock is as follows:

?

The plants sell for $1 each and your firm faces no other costs. The real interest rate is 10% and the depreciation rate of capital is 15%. There is a 20% tax on your firm's revenues from selling these plants.

a. What is the firm's tax-adjusted user cost of capital?

b. What is the marginal product of capital for each number of machines (1, 2, 3, 4, and 5)?

c. How many machines should the firm buy? What is their production, pretax revenue, and profit after deducting taxes, interest, and depreciation?

Correct Answer:

Verified

Q1: Franco the economist uses data for Canada

Q2: A firm has current and future marginal

Q4: Consider a Keynesian consumption function with desired

Q5: Suppose the current account shows debits of

Q6: Suppose a country has the following balance

Q7: Consider a small open economy with desired

Q8: A large open economy has desired national

Q9: Briefly discuss the idea of "twin deficit."

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents