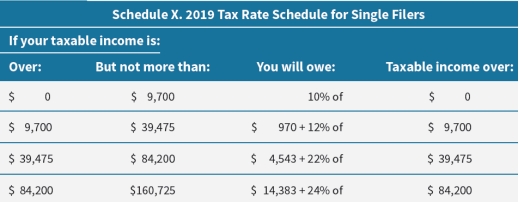

Natasha had earned income of $58,500 and will claim the standard deduction of $12,200 as a single taxpayer. If she has no other adjustment to her tax return, what will she owe in taxes? (Round to nearest whole number.)

A) $6,045

B) $8,729

C) $10,186

D) $12,870

Correct Answer:

Verified

Q38: Hector has been very busy with his

Q39: Greg and Jamie are married and both

Q40: Matthew is 16 years old and can

Q41: While preparing his tax return, Emilio accidentally

Q42: Heidi filed as a head of household

Q44: The first step in calculating federal income

Q45: Which of the following is not included

Q46: Which of the following must be included

Q47: Lee earned a salary of $25,000 from

Q48: Whether your investment income qualifies for capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents