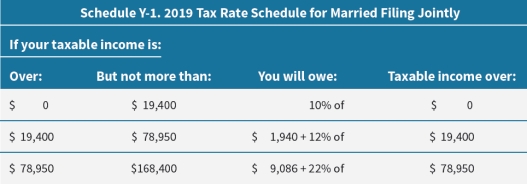

Bill and Miley had an adjusted gross income of $75,000. They file taxes jointly and the standard deduction for married filing jointly is $24,400. They listed their itemized expenses as follows: home mortgage interest, $4,750; house property tax, $5,890; state income tax, $3,000; and charitable gifts (market value) , $245. How much do they owe in federal income tax?

A) $5,684

B) $6,072

C) $6,946

D) $7,334

Correct Answer:

Verified

Q59: Yvonne's adjusted gross income is $54,455. She

Q60: Jim and Judy file taxes jointly as

Q61: To calculate taxable income, which of the

Q62: David and Elaine have an AGI of

Q63: Yulia and Mikhail had a joint taxable

Q65: Donald sold his primary residence for $198,425

Q66: Some of the cost of child-care expenses

Q67: Which of the following tax credits best

Q68: Which of the following tax credits applies

Q69: Which of the following tax credits best

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents