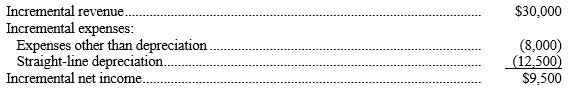

Beacon Manufacturing, Inc. is planning to buy a new cutting machine. The machine costs $125,000, has an estimated life of ten years and no salvage value. The machine is expected to have the following impact:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

-What is the net present value of the cutting machine discounted at an annual rate of 10%, if the present value of a ten-year $1 annuity discounted at 10% is 6.145? $____________

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Physician's Pharmacy is considering the purchase of

Q7: Physician's Pharmacy is considering the purchase of

Q8: Physician's Pharmacy is considering the purchase of

Q9: Physician's Pharmacy is considering the purchase of

Q10: Physician's Pharmacy is considering the purchase of

Q11: Port Pharmacy is considering the purchase of

Q12: Beacon Manufacturing, Inc. is planning to buy

Q13: Beacon Manufacturing, Inc. is planning to buy

Q14: Beacon Manufacturing, Inc. is planning to buy

Q16: Beacon Manufacturing, Inc. is planning to buy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents