Louisville Farms, a breeder of racehorses, paid $432,000 cash for a prize-winning stallion on January 1, Year 1. The stallion is depreciated on a straight-line basis, with depreciation for partial years rounded to the nearest month. Estimated useful life was nine years, with no residual value. After owning the animal for six years and five months, Louisville Farms sold the stallion on May 31, Year 7, for cash of $85,000. Depreciation had last been recorded on December 31, Year 6.

a) Compute to the nearest full month depreciation for the fractional period from January 1, Year 7 to May 31 of Year 7. $______________

b) Compute the book value of the stallion at May 31, Year 7, the date of sale.$______________

c) Compute the gain or loss on the sale of the stallion. $______________ (gain/loss)

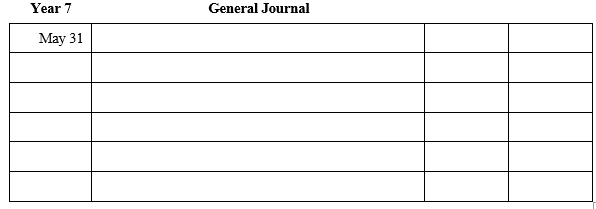

d) In the space provided below, prepare the journal entry to record the sale of the stallion on May 31, Year 7. (Use Breeding Stock as the title of the asset account. Assume that depreciation to date of sale already has been recorded.)

Correct Answer:

Verified

b) $124,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: On March 12, Year 1, Shoreham, Inc.

Q2: On March 12, Year 1, Shoreham, Inc.

Q3: Sayville Dairy sold a delivery truck for

Q4: Cage Corporation purchases Presley Company's entire business

Q5: Throughout the current year, Calverton Company treated

Q6: On May 5, Year 1, Lloyd purchased

Q7: On May 5, Year 1, Lloyd purchased

Q8: On May 5, Year 1, Lloyd purchased

Q9: On May 5, Year 1, Lloyd purchased

Q10: On April 8, Year 1, Dreamland Park

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents