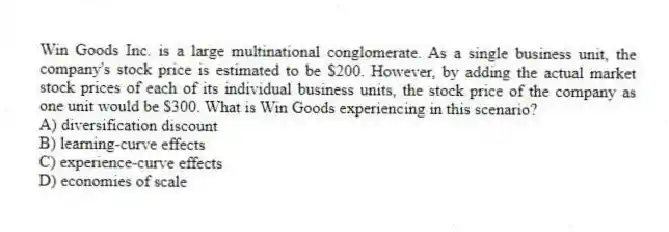

Win Goods Inc. is a large multinational conglomerate. As a single business unit, the company's stock price is estimated to be $200. However, by adding the actual market stock prices of each of its individual business units, the stock price of the company as one unit would be $300. What is Win Goods experiencing in this scenario?

A) diversification discount

B) learning-curve effects

C) experience-curve effects

D) economies of scale

Correct Answer:

Verified

Q58: Beagle Autos is known for its affordable

Q59: Firms that use taper integration also use

Q60: Groundswell Industries, a U.S.-based large conglomerate, competes

Q61: WJ Group Inc., a large multinational conglomerate,

Q62: With reference to the Strategy Highlight 8.2,

Q64: The smartphone division of the large consumer

Q65: ESB Group is the parent company of

Q66: How does a conglomerate benefit from following

Q67: In the context of the Boston Consulting

Q68: Coca-Cola was primarily known for its core

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents