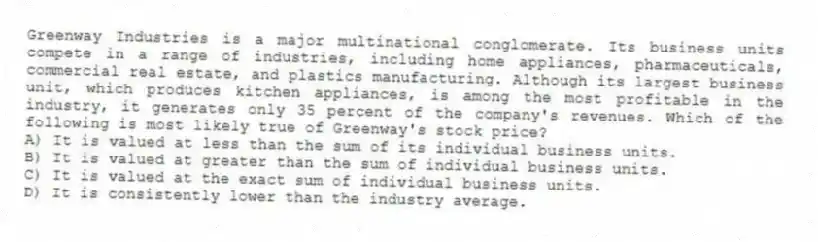

Greenway Industries is a major multinational conglomerate. Its business units compete in a range of industries, including home appliances, pharmaceuticals, commercial real estate, and plastics manufacturing. Although its largest business unit, which produces kitchen appliances, is among the most profitable in the industry, it generates only 35 percent of the company's revenues. Which of the following is most likely true of Greenway's stock price?

A) It is valued at less than the sum of its individual business units.

B) It is valued at greater than the sum of individual business units.

C) It is valued at the exact sum of individual business units.

D) It is consistently lower than the industry average.

Correct Answer:

Verified

Q64: The smartphone division of the large consumer

Q65: ESB Group is the parent company of

Q66: How does a conglomerate benefit from following

Q67: In the context of the Boston Consulting

Q68: Coca-Cola was primarily known for its core

Q70: ElectraSync Inc., a large consumer electronics company,

Q71: Which quadrant in the core competence-market matrix

Q72: The core competency of GoGo Motors is

Q73: Real Goods Inc. is a large conglomerate.

Q74: BestDrive Inc. is a large automobile company.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents