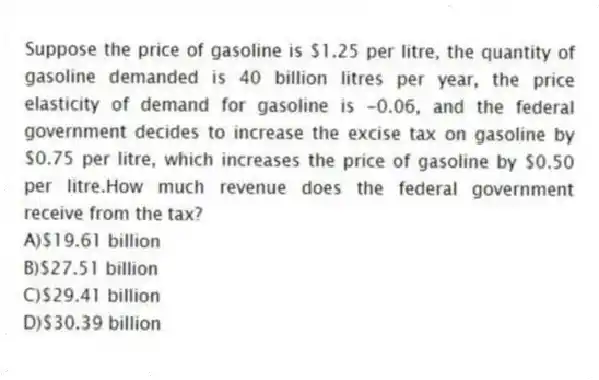

Suppose the price of gasoline is $1.25 per litre, the quantity of gasoline demanded is 40 billion litres per year, the price elasticity of demand for gasoline is -0.06, and the federal government decides to increase the excise tax on gasoline by $0.75 per litre, which increases the price of gasoline by $0.50 per litre.How much revenue does the federal government receive from the tax?

A) $19.61 billion

B) $27.51 billion

C) $29.41 billion

D) $30.39 billion

Correct Answer:

Verified

Q112: Figure 6-5 Q114: In September 2006, the Canadian Food Inspection Q119: Which of the following is one reason Q122: Suppose the price elasticity of demand for Q186: The cross-price elasticity of demand between an Q187: If the cross-price elasticity of demand between Q213: In recent years, the prices of new Q222: Suppose a 4 percent increase in income Q231: What factors would make you more sensitive Q242: An increase in the demand for green![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents