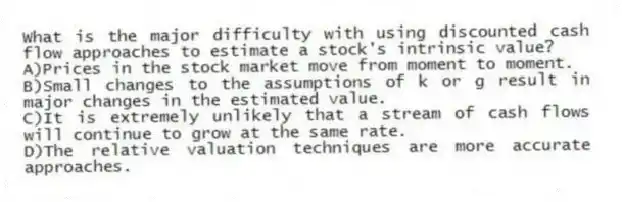

What is the major difficulty with using discounted cash flow approaches to estimate a stock's intrinsic value?

A) Prices in the stock market move from moment to moment.

B) Small changes to the assumptions of k or g result in major changes in the estimated value.

C) It is extremely unlikely that a stream of cash flows will continue to grow at the same rate.

D) The relative valuation techniques are more accurate approaches.

Correct Answer:

Verified

Q1: Carl is evaluating a stock that just

Q9: Mr. & Mrs. Jones plan to buy

Q14: What is used as "earnings" in the

Q14: Which of the following increases the price

Q15: Which of the following descriptions of the

Q16: Which of the following is not used

Q17: Sam is evaluating a stock that is

Q18: What are two major approaches used to

Q19: Stephen used the dividend discount model to

Q22: Sometimes analysts use other ratios such as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents