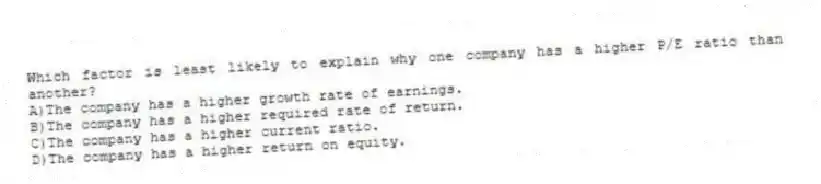

Which factor is least likely to explain why one company has a higher P/E ratio than another?

A) The company has a higher growth rate of earnings.

B) The company has a higher required rate of return.

C) The company has a higher current ratio.

D) The company has a higher return on equity.

Correct Answer:

Verified

Q1: Carl is evaluating a stock that just

Q7: Which measure relies on the cash flow

Q15: Which of the following descriptions of the

Q18: What are two major approaches used to

Q22: Sometimes analysts use other ratios such as

Q23: Economic value added (EVA) indicates the amount

Q23: Hannett Inc.has a stock price of $40

Q28: No one knows with precision which valuation

Q33: Stan expects Terta Corp. to pay its

Q40: Riza Corporation's preferred stock has a par

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents