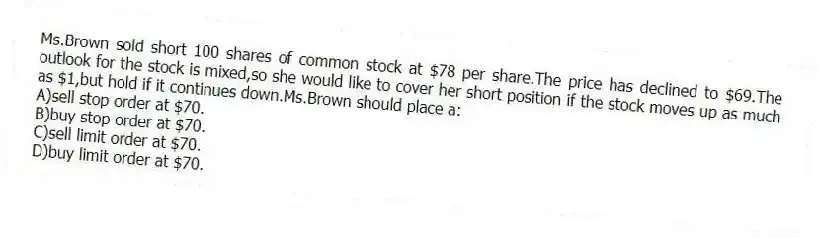

Ms.Brown sold short 100 shares of common stock at $78 per share.The price has declined to $69.The outlook for the stock is mixed,so she would like to cover her short position if the stock moves up as much as $1,but hold if it continues down.Ms.Brown should place a:

A) sell stop order at $70.

B) buy stop order at $70.

C) sell limit order at $70.

D) buy limit order at $70.

Correct Answer:

Verified

Q2: If an investor is attempting to buy

Q4: Which of the following accounts often requires

Q12: Open limit orders, if not cancelled or

Q16: Direct stock purchase programs (DSPs)are an outgrowth

Q18: The NYSE minimum deposit for margin accounts

Q22: Questions are based on the following information:

An

Q23: The NYSE is:

A) a free agent market.

B)

Q24: Questions are based on the following information:

An

Q25: The law that requires that all new

Q36: A sell stop order is placed:

A) above

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents