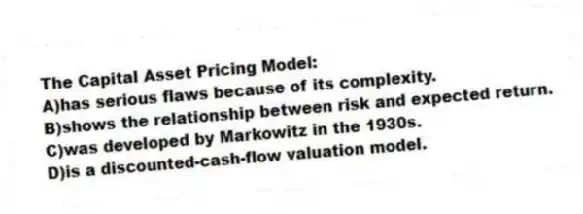

The Capital Asset Pricing Model:

A) has serious flaws because of its complexity.

B) shows the relationship between risk and expected return.

C) was developed by Markowitz in the 1930s.

D) is a discounted-cash-flow valuation model.

Correct Answer:

Verified

Q9: The separation theorem states that:

A) systematic risk

Q11: Which of the following statements about the

Q14: Which of the following statements about the

Q14: Which of the following is the correct

Q15: Which of the following is generally used

Q16: Which of the following is an assumption

Q17: Which of the following is not one

Q17: The expected return on the market for

Q18: What does it mean when the CAPM

Q20: Securities with betas greater than l should

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents