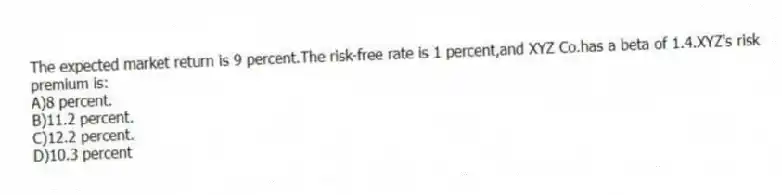

The expected market return is 9 percent.The risk-free rate is 1 percent,and XYZ Co.has a beta of 1.4.XYZ's risk premium is:

A) 8 percent.

B) 11.2 percent.

C) 12.2 percent.

D) 10.3 percent

Correct Answer:

Verified

Q22: The most volatile stocks have betas near

Q26: Which of the following is not an

Q36: The CML indicates the required return for

Q37: The expected market return is 16 percent.The

Q40: Which of the following is not a

Q42: Like the CAPM, the APT assumes a

Q45: None of the asset-pricing models assume that

Q51: Most professional investors use the S&P 500

Q53: Like CAPM, APT does not assume a

Q59: The CML states that all investors should

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents