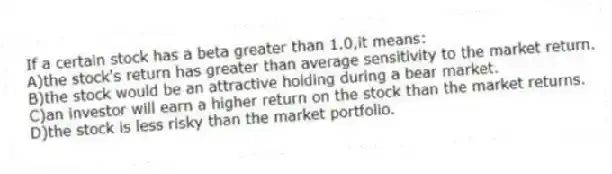

If a certain stock has a beta greater than 1.0,it means:

A) the stock's return has greater than average sensitivity to the market return.

B) the stock would be an attractive holding during a bear market.

C) an investor will earn a higher return on the stock than the market returns.

D) the stock is less risky than the market portfolio.

Correct Answer:

Verified

Q21: If markets are efficient and in equilibrium:

A)

Q22: The most volatile stocks have betas near

Q25: Using the separation theorem, it is necessary

Q27: Under the Market model, the regression line

Q28: The APT is based on the:

A) law

Q30: Which of the following might be used

Q39: For which of the following models is

Q44: Beta is a measure of systematic risk

Q51: Most professional investors use the S&P 500

Q59: The CML states that all investors should

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents