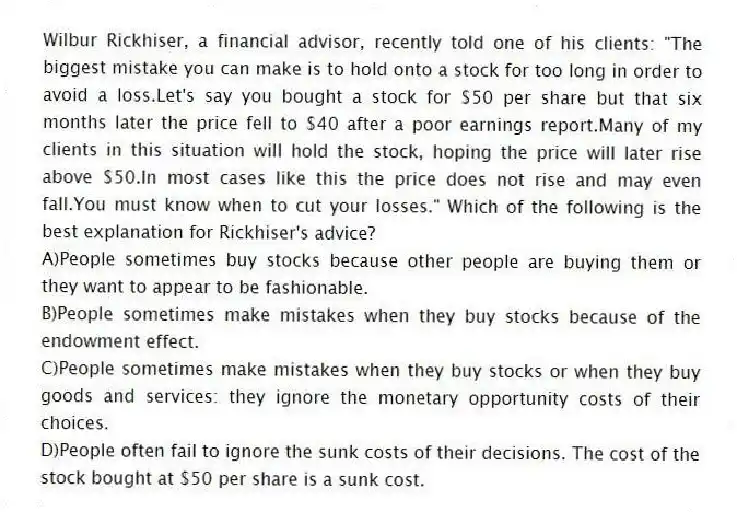

Wilbur Rickhiser, a financial advisor, recently told one of his clients: "The biggest mistake you can make is to hold onto a stock for too long in order to avoid a loss.Let's say you bought a stock for $50 per share but that six months later the price fell to $40 after a poor earnings report.Many of my clients in this situation will hold the stock, hoping the price will later rise above $50.In most cases like this the price does not rise and may even fall.You must know when to cut your losses." Which of the following is the best explanation for Rickhiser's advice?

A) People sometimes buy stocks because other people are buying them or they want to appear to be fashionable.

B) People sometimes make mistakes when they buy stocks because of the endowment effect.

C) People sometimes make mistakes when they buy stocks or when they buy goods and services: they ignore the monetary opportunity costs of their choices.

D) People often fail to ignore the sunk costs of their decisions. The cost of the stock bought at $50 per share is a sunk cost.

Correct Answer:

Verified

Q228: Suppose Adam Einberg pays $100 for a

Q229: Alan Krueger conducted a survey of fans

Q230: One reason that consumers and businesses might

Q231: Behavioral economics refers to the study of

Q232: Which of the following is a common

Q234: The highest-valued alternative that must be given

Q235: Health clubs typically experience an increase in

Q236: Alan Krueger conducted a survey of fans

Q237: Alan Krueger conducted a survey of fans

Q238: Behavioral economics helps explain why customers _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents