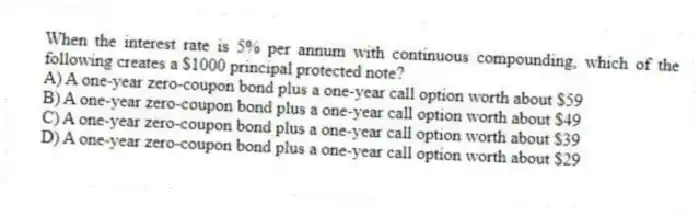

When the interest rate is 5% per annum with continuous compounding, which of the following creates a $1000 principal protected note?

A) A one-year zero-coupon bond plus a one-year call option worth about $59

B) A one-year zero-coupon bond plus a one-year call option worth about $49

C) A one-year zero-coupon bond plus a one-year call option worth about $39

D) A one-year zero-coupon bond plus a one-year call option worth about $29

Correct Answer:

Verified

Q1: Which of the following is true of

Q4: How can a strip trading strategy be

Q5: Six-month call options with strike prices of

Q7: Which of the following is correct?

A) A

Q8: How can a strap trading strategy be

Q11: Which of the following describes a protective

Q17: Which of the following creates a bear

Q18: A trader creates a long butterfly spread

Q19: What is the number of different option

Q20: A stock price is currently $23.A reverse

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents