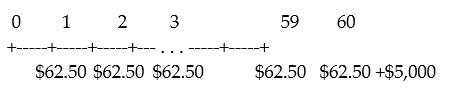

A corporation issues a bond that generates the above cash flows.If the periods shown are 3 months,which of the following best describes that bond?

A) a 15-year bond with a notional value of $5000 and a coupon rate of 5% paid quarterly

B) a 15-year bond with a notional value of $5000 and a coupon rate of 1.25% paid annually

C) a 30-year bond with a notional value of $5000 and a coupon rate of 3.75% paid semi-annually

D) a 60-year bond with a notional value of $5000 and a coupon rate of 5% paid quarterly

E) a 30-year bond with a notional value of $5000 and a coupon rate of 2.5% paid semi-annually

Correct Answer:

Verified

Q2: How much will the coupon payments be

Q4: Which of the following best illustrates why

Q6: A corporate bond makes payments of $9.67

Q7: A bond is said to mature on

Q7: Which of the following best shows the

Q9: What is the coupon rate of a

Q10: Prior to its maturity date, the price

Q12: What is the coupon rate of a

Q14: Treasury bills have original maturities from one

Q18: The coupon value of a bond is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents