Multiple Choice

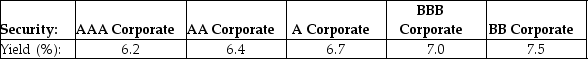

Consolidated Insurance wants to raise $35 million in order to build a new headquarters.The company will fund this by issuing 10-year bonds with a face value of $1,000 and a coupon rating of 6.5%,paid semi-annually.The above table shows the yield to maturity for similar 10-year corporate bonds of different ratings.Which of the following is closest to how many more bonds Consolidated Insurance would have to sell to raise this money if their bonds received an A rating rather than an AA rating?

A) 686

B) 750

C) 765

D) 1156

E) 872

Correct Answer:

Verified

Related Questions

Q103: What rating must Luther receive on these

Q107: A firm issues 20-year bonds with a

Q108: Use the information for the question(s)below.