Multiple Choice

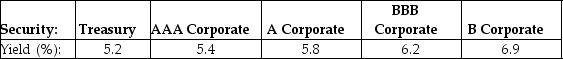

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-

The credit spread of the B corporate bond is closest to:

A) 1.6%

B) 0.8%

C) 1.0%

D) 1.4%

E) 1.8%

Correct Answer:

Verified

Related Questions

Q107: A firm issues 20-year bonds with a

Q108: Use the information for the question(s)below.

Q109: Use the table for the question(s) below.

Consider