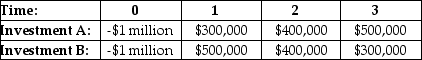

An investor is considering the two investments shown above.Her cost of capital is 9%.Which of the following statements about these investments is true?

A) The investor should take investment A since it has a greater net present value (NPV) .

B) The investor should take investment A since it has a greater internal rate of return (IRR) .

C) The investor should take investment B since it has a greater net present value (NPV) .

D) The investor should take investment B since it has a greater internal rate of return (IRR) .

E) The investor should take investment B since it has a shorter payback period.

Correct Answer:

Verified

Q85: Why is the internal rate of return

Q86: Two mutually exclusive investment opportunities require an

Q89: The cash flows for four projects are

Q90: A janitorial services firm is considering two

Q91: When comparing two projects with different lives,why

Q94: Use the table for the question(s) below.

Consider

Q97: When using equivalent annual annuities to compare

Q98: The following show four mutually exclusive investments.Which

Q98: What is a safe method to use

Q99: A security company offers to provide CCTV

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents