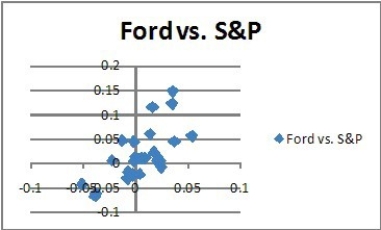

You observe the following scatterplot of Ford's weekly returns against the S&P 500.Which of the following statements is true about Ford's beta against the S&P 500?

A) Ford's beta appears to be positive.

B) Ford's beta appears to be negative.

C) Ford's beta appears to be zero- there is no apparent relation between its return and the S&P return.

D) Ford's beta appears to be highly negative.

E) Beta has nothing to do with the relationship seen in this scatterplot.

Correct Answer:

Verified

Q44: A stock market comprises 5000 shares of

Q46: A stock market comprises 5000 shares of

Q58: A stock market comprises 2000 shares of

Q61: Air Canada stock has a standard deviation

Q63: The market portfolio is the portfolio of

Q64: A linear regression to estimate the relation

Q70: Since total risk is greater than systematic

Q70: You expect General Motors (GM)to have a

Q72: Is it possible for a stock to

Q77: The market or equity risk premium can

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents