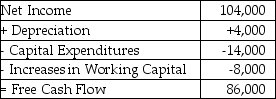

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 6% per year.If Monroe were able to reduce its annual increase in working capital by 15% without affecting any other part of the business adversely,what would be the effect of this reduction on Monroe's value,given a cost of capital of 11%?

A) an increase of $3000

B) an increase of $8000

C) an increase of $12,000

D) an increase of $24,000

E) an increase of $258,000

Correct Answer:

Verified

Q22: Collection float is the amount of time

Q23: Franklin Industries has a current net working

Q24: Use the table for the question(s)below.

Luther Industries

Q25: Use the table for the question(s)below.

Luther Industries

Q30: Use the table for the question(s)below.

Luther Industries

Q32: Which of the following would increase a

Q35: The difference between a firm's operating cycle

Q38: ALT had $25 million in sales last

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents