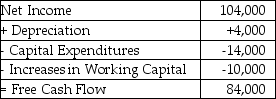

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 4% per year.and has a cost of capital of 8%.Monroe wishes to achieve a 5% increase in firm value.If the rest of the business remains unchanged,what reduction in working capital increases would Monroe require in order to achieve this goal?

A) $2,000

B) $4,200

C) $5,800

D) $10,000

E) $8,000

Correct Answer:

Verified

Q6: Brilliant Balloons,a party balloon manufacturer,buys latex on

Q7: Gencom International has inventory days of 33,accounts

Q13: Gencom International has inventory days of 22,and

Q17: Jerome Industries has inventory days of 15,accounts

Q21: Use the table for the question(s)below.

Luther Industries

Q26: Which of the following firms would be

Q27: What is a firm's operating cycle?

Q32: What is a firm's cash cycle?

Q33: Which of the following would decrease a

Q34: ALT had $25 million in sales last

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents