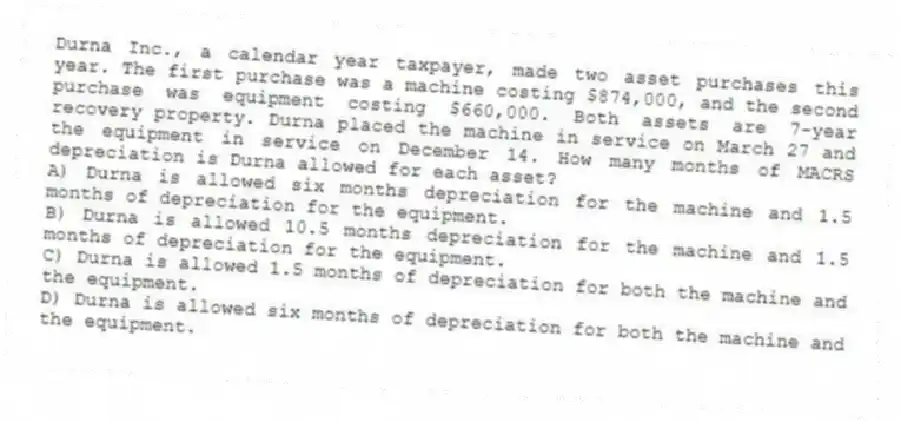

Durna Inc., a calendar year taxpayer, made two asset purchases this year. The first purchase was a machine costing $874,000, and the second purchase was equipment costing $660,000. Both assets are 7-year recovery property. Durna placed the machine in service on March 27 and the equipment in service on December 14. How many months of MACRS depreciation is Durna allowed for each asset?

A) Durna is allowed six months depreciation for the machine and 1.5 months of depreciation for the equipment.

B) Durna is allowed 10.5 months depreciation for the machine and 1.5 months of depreciation for the equipment.

C) Durna is allowed 1.5 months of depreciation for both the machine and the equipment.

D) Durna is allowed six months of depreciation for both the machine and the equipment.

Correct Answer:

Verified

Q40: Which of the following statements concerning deductible

Q48: Lensa Inc. purchased machinery several years ago

Q58: Which of the following statements about the

Q61: Kaskar Company,a calendar year taxpayer,paid $3,350,000 for

Q62: Broadus, a calendar year taxpayer, purchased a

Q63: Cobly Company, a calendar year taxpayer, made

Q67: Essco Inc., a calendar year taxpayer, made

Q68: Which of the following statements about MACRS

Q69: Norwell Company purchased $1,413,200 of new business

Q73: Gowda Inc.,a calendar year taxpayer,purchased $1,496,000 of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents