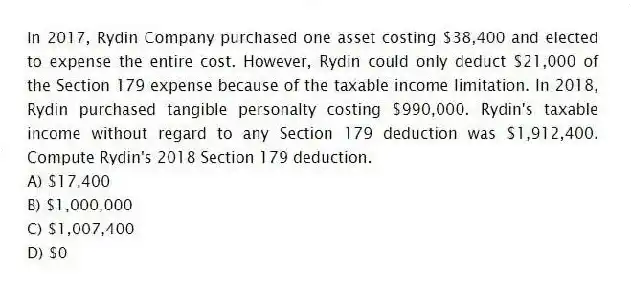

In 2017, Rydin Company purchased one asset costing $38,400 and elected to expense the entire cost. However, Rydin could only deduct $21,000 of the Section 179 expense because of the taxable income limitation. In 2018, Rydin purchased tangible personalty costing $990,000. Rydin's taxable income without regard to any Section 179 deduction was $1,912,400. Compute Rydin's 2018 Section 179 deduction.

A) $17,400

B) $1,000,000

C) $1,007,400

D) $0

Correct Answer:

Verified

Q86: Which of the following statements about amortization

Q89: Mann Inc., a calendar year taxpayer, incurred

Q92: Puloso Company, a calendar year taxpayer,

Q92: Merkon Inc.must choose between purchasing a new

Q93: Mann Inc. negotiated a 36-month lease on

Q94: Ingol,Inc.was organized on June 1 and began

Q96: Which of the following statements concerning business

Q97: Four years ago, Bettis Inc. paid a

Q98: Mr and Mrs Schulte paid a $750,000

Q100: Which of the following capitalized cost is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents