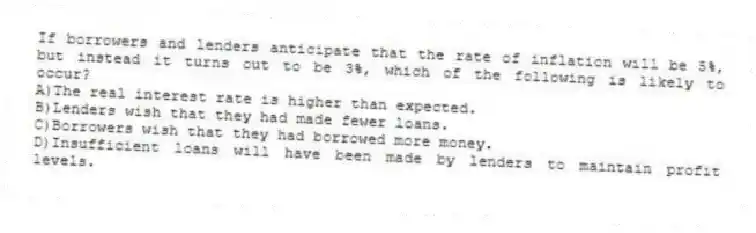

If borrowers and lenders anticipate that the rate of inflation will be 5%, but instead it turns out to be 3%, which of the following is likely to occur?

A) The real interest rate is higher than expected.

B) Lenders wish that they had made fewer loans.

C) Borrowers wish that they had borrowed more money.

D) Insufficient loans will have been made by lenders to maintain profit levels.

Correct Answer:

Verified

Q65: What are 'menu costs'?

A)The full list of

Q66: Who, of the following options, does not

Q67: What is caused by high anticipated inflation?

A)Real

Q69: Which of the following statements is true?

A)When

Q71: Financial institutions who have loaned money at

Q72: What is the cost to firms of

Q73: There is a negative relationship between real

Q74: If inflation is completely anticipated:

A)no-one loses.

B)borrowers lose.

C)lenders

Q75: Suppose you obtain a fixed interest rate

Q264: Inflation that is _ than what is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents