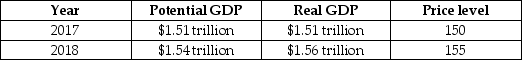

Suppose the following table illustrates the values of real and potential GDP and the price level, if the Reserve Bank of Australia (RBA)does not change its current policy to be more contractionary or expansionary.

If the RBA wants to keep real GDP at its potential level in 2018, should the RBA use a contractionary or expansionary policy? Should it raise or lower its interest rate target? How should it conduct open market operations to achieve its goal?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: What effect will a rise in interest

Q90: The Australian share market:

A)does not care about

Q91: Refer to Table 12.2 for the following

Q92: Refer to Table 12.2 for the following

Q93: If the overnight cash rate falls, then

Q95: A 'liquidity trap' is a situation in

Q96: Suppose the following table illustrates the values

Q97: If the Reserve Bank of Australia sells

Q98: Suppose the following table illustrates the values

Q99: If interest rates rise:

A)an investment in shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents