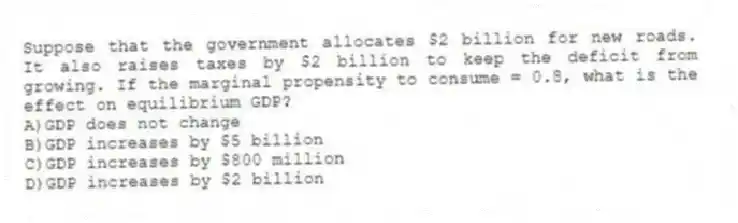

Suppose that the government allocates $2 billion for new roads. It also raises taxes by $2 billion to keep the deficit from growing. If the marginal propensity to consume = 0.8, what is the effect on equilibrium GDP?

A) GDP does not change

B) GDP increases by $5 billion

C) GDP increases by $800 million

D) GDP increases by $2 billion

Correct Answer:

Verified

Q68: Suppose real GDP is $1.3 trillion and

Q69: Outline the differences between the government 'purchases

Q70: Raising taxes will:

A)raise disposable income and raise

Q71: The government 'purchases multiplier' always has a

Q72: Induced taxes and transfer payments reduce the

Q74: The tax multiplier:

A)is negative.

B)is larger in absolute

Q75: If the absolute value of the tax

Q76: A cut in tax rates affects equilibrium

Q77: The government purchases multiplier will be larger

Q78: Assume in a closed economy that taxes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents