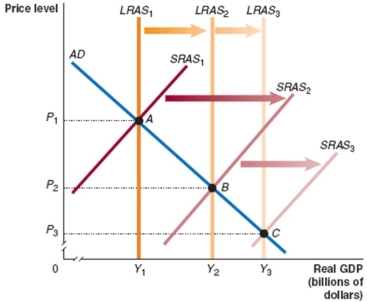

Show the effects of tax reduction and simplification using the dynamic aggregate demand and supply model. To simplify the analysis, assume that the aggregate demand curve does not change. How does the analysis change if the tax change does not change labour supply and has little or no effect on savings and investment?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q134: During an 'economic contraction', why is it

Q135: Reducing the marginal tax rate on individual

Q136: Is government debt bad for the economy?

_

_

Q137: The 'Phillips curve' illustrates that there is

Q138: If tax reduction and simplification are effective,

Q140: As the tax wedge between pre-tax and

Q141: A vertical long-run Phillips curve implies that

Q142: If workers fail to believe that rising

Q143: Both Milton Friedman and Edmund Phelps argued

Q144: Policy-makers in the 1960s believed that there

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents