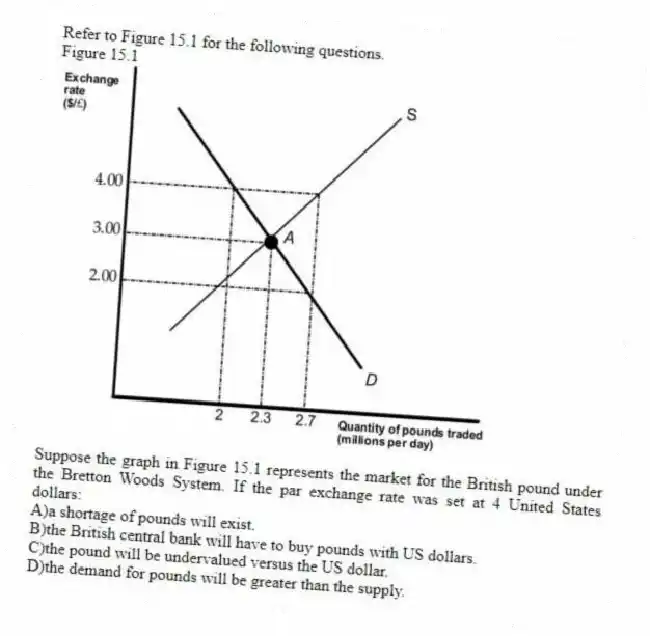

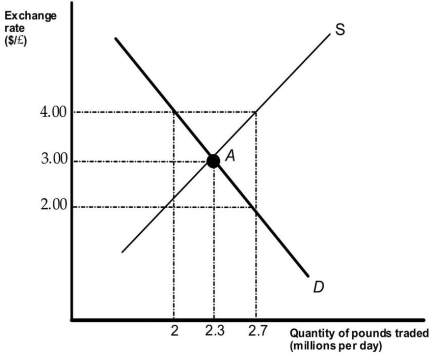

Refer to Figure 15.1 for the following questions.

Figure 15.1

-Suppose the graph in Figure 15.1 represents the market for the British pound under the Bretton Woods System. If the par exchange rate was set at 4 United States dollars:

A) a shortage of pounds will exist.

B) the British central bank will have to buy pounds with US dollars.

C) the pound will be undervalued versus the US dollar.

D) the demand for pounds will be greater than the supply.

Correct Answer:

Verified

Q33: During the Great Depression, many countries left

Q34: Under the 'gold standard':

A)there was no inflation.

B)the

Q35: Under the Bretton Woods System, central banks

Q36: If a currency's par rate (defined as

Q37: Foreign currency prices of the Australian dollar

Q39: Countries abandoned the 'gold standard' during periods

Q40: The Bretton Woods System was a system

Q41: Soon after the Australia dollar was floated,

Q42: Describe how the 'Bretton Woods System' operated.

_

_

Q43: What is a 'gold standard'? What kind

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents