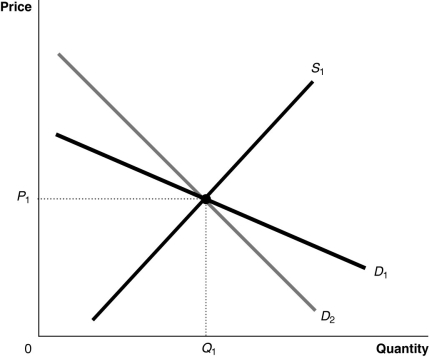

Figure 4-10

-Refer to Figure 4-10.Suppose the market is initially in equilibrium at price P₁ and then the government imposes a tax on every unit sold.Which of the following statements best describes the impact of the tax?

A) The consumer will bear a smaller share of the tax burden if the demand curve is D₁.

B) The consumer's share of the tax burden is the same whether the demand curve is D₁ or D₂.

C) The consumer will bear a smaller share of the tax burden if the demand curve is D₂.

D) The consumer will bear the entire burden of the tax if the demand curve is D₂ and the producer will bear the entire burden of the tax if the demand curve is D₁.

Correct Answer:

Verified

Q162: Suppose the demand curve for a product

Q163: Article Summary

Voters in California approved a $2